In December 2018, a bill to amend the Immigration Control and Refugee Recognition Act was passed, allowing from April 2019 the acceptance of new foreign workers under the "Specified Skilled Worker" status in industries facing severe labor shortages. Numerous cases have been reported of technical intern trainees in Japan getting injured, falling ill, or passing away while staying in Japan. As a result, a similar insurance scheme has been developed for Specified Skilled Workers (i). The Japanese government's comprehensive measures for the acceptance and coexistence of foreign workers include recommendations that businesses employing Specified Skilled Worker (i) employees enroll in private insurance. Please take advantage of this policy to ensure smooth and stable employment under the Specified Skilled Worker (i) program.

Features

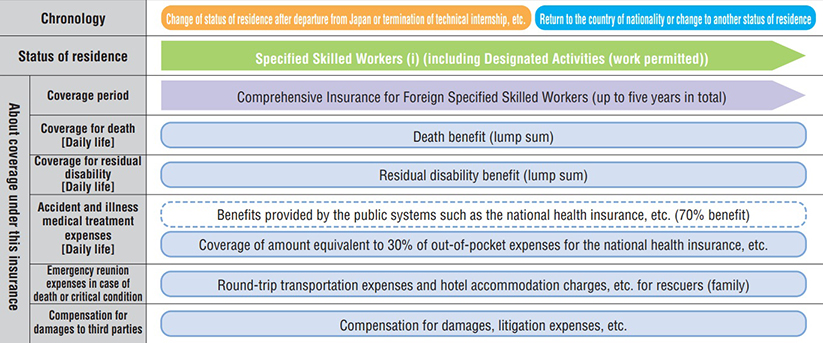

(1) Coverage is provided throughout the entire period from completion of procedures for departure from the country of nationality until the conclusion of procedures for return to the country of nationality after completing the period of activity as a specified skilled worker (i), or until changing of another status of residence.

(1) Coverage is provided throughout the entire period from completion of procedures for departure from the country of nationality until the conclusion of procedures for return to the country of nationality after completing the period of activity as a specified skilled worker (i), or until changing of another status of residence.

(2) As it comes under employment by companies immediately after entry into Japan, this

product is designed to cover the 30% out-of-pocket expenses for medical treatment

expenses from the beginning.

(3) JI Accident & Fire Insurance Co., Ltd, the underwriting insurance company, is a joint

venture between JTB Group, Japan's largest travel agency, and AIG Group, which is engaged in the non-life insurance business worldwide.

Coverage Period(Period of Liability)

Coverage is provided throughout the entire period from completion of the immigration procedures, etc. at the specified skilled worker’s country of nationality until the conclusion of the specified skilled worker (i) program in Japan and the completion of the arrival procedures, etc. when returning to his or her country of nationality or or changing of his or her status of residence.

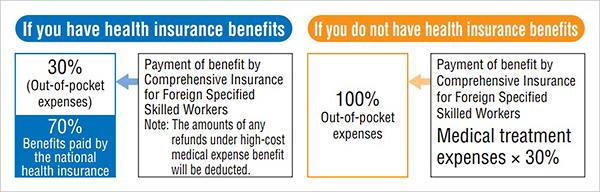

■For medical treatment expenses, an amount equivalent to 30% of out-of-pocket expenses will

be covered, excluding 70% of benefits provided by public systems such as national health

insurance, etc.

■Payment of benefits for accident death, accident disability, accident medical treatment expenses,

illness medical treatment expenses, and illness death will not be covered if the injury or illness

is attributable to work or commute.

■It is also possible to enroll in the middle of your stay.

■In the following cases, the maximum amount of benefit paid will be the amount obtained by

multiplying 30% of the actual medical treatment expense, etc. borne by the insured.

・No employment contract is concluded under the national health insurance, etc.

・The person is not the insured under the national health insurance, etc. during the period from

the departure from Japan after the completion of activity as a specified skilled workers (i)

until the completion of the procedures for returning to the country of nationality, etc.

Coverage

Primary cases in which insurance payment will be paid are listed in the table below.

Benefit |

Primary cases in which we pay Insurance Benefit |

Insurance Benefit that we pay | |

| A C C I D E N T |

Accident Death | When the insured person dies within 180 days of an accident that occurred during the period of liability, inclusive of the date of the accident, due to an injiry he sustained in the accident. | The full amount of the claim for death due to injury will be paid to the insured person's legal heir. If a beneficiary of the death benefit has been specified, payment will be made to that person. If a payment for permanent disability has already been made (when the period of insurance exceeds 1 year, if a payment for permanent disability has already been made in relation to an accident that occurred within the same policy year), an amount will be paid after deducting the sum that has already been paid from the amount of the claim payment for death due to injury. |

| Accident Disability | When the insured person suffers a permanent physical disability within 180 days of an accident that occurred during the period of liability, inclusive of the date of the accident, due to an injury he or she sustained in the accudent. | Between 4% and 100% of the claim for permanent disability following injury will be paid according to the degree of permanent disability. The upper limit will be the combined sum insured for permanent disability following injury throughout the period of insurance (for each policy year if the period of insurance exceeds 1 year). |

|

| Accident Medical Expenses |

When the insured person has received medical treatment for an injury sustained in an accident that occurred during the period of liability. | A sum will be paid from among the following actually incurred treatment expenses, etc., which is deemed appropriate based on commonly accepted norms, within the scope of the sum insured for accident treatment expenses and the sum insured for illness treatment expenses, for each single injury or illness. However, this will be limited to the expenses necessitated within a period of 180 days from the date of occurrence of the accident, inclusive of that date, in the case of injury, and within a period of 180 days from the first day of treatment, inclusive of that date, in the case of illness. |

|

| I L L N E S S |

Sickness Medical Expenses | (1) When the insured person has commenced treatment within 72 hours of the end of the period of liability due to an illness that presented itself during the period of liability or within 72 hours of the end of the period of liability. However, if the illness presented itself after the end of the period of liability, this is limited to a case in which the cause arose during the period of liability. (2) When treatment commenced within 30 days of the last day of the period of liability, inclusive of that day, due to a specified infectious disease that was contracted during the period of liability. |

|

| Sickness Death |

(1) When the insured person dies during the period of liability due to an illness. (2) In the event of death within 30 days of the last day of the period of liability, inclusive of that day, due to an illness that presented itself during the period of liability, or due to an illness that presented itself within 72 hours of the end of the period of liability, the cause of which occurred during the period of liability. (However, this is limited to a case in which treatment has started during the period of liability or within 72 hours of expiry of the period of liability, and continues to be made theireafter). (3) In the event of death within 30 days of the last day of the period of liability, inclusive of that day, due to a specified infectious disease that was contracted during the period of liability. |

The full amount of the claim for death due to illness will be paid to the insured person's legal heir. If a beneficiary of the death benefit has been specified, payment will be made to that person. | |

| Personal Liability | When the insured person inflicts damage on another person by injuring any other person or damaging another party's property during the period of liability due to an accidental event, and incurs a legal liability to pay compensation for damages. | The amount of the compensation for damages is paid. The upper limit is the sum insured under liability insurance, per single event. There are cases in which it may also be possible to pay a claim for any necessary and beneficial expenses incurred to prevent the occurrence of damages or to limit their expansion, and for legal costs, lawyers' remuneration, etc. paid out with the agreement of the insurance company. |

|

| Emergency Reunion Expenses, etc. | The insured person (1) dies within 180 days of an accident that occurred during the period of liability, inclusive of the date of the accident, due to an injury he sustained in the accident. (2) dies during the period of liability due to illness, pregnancy, childbirth, premature birth or miscarriage. (3) dies within 30 days of the last day of the period of liability, inclusive of that day, due to an illness that presented itself during the period of liability. (However, this is limited to a case in which treatment was initiated during the period of liability and continuous treatment was received after this period). (4) dies within 180 days of a suicidal act that was carried out during the period of liability, inclusive of the day on which the act was carried out. (5) becomes critically ill during the period of liability (in the opinion of a doctor, his life is in danger due to a serious injury or illness and the outcome is uncertain). (6) is on board or travelling in an aircraft or shipping vessel that suffers an accident during the period of liability. (Including when missing). |

A sum will be paid from among the following expenses actually incurred by the policyholder, insured person and their relatives, which is deemed appropriate based on commonly accepted norms, within the scope of the sum insured for emergency reunion expenses, etc. throughout the period of insurance. (1)Search and rescue expenses, (2) cost of round-trip airfare or other form of travel to the location by the person(s) providing relief (up to 3 persons), (3) cost of accommodation for the person(s) providing relief, both at the local site and during the journey to the local site (up to 14 days of accommodation per person for 3 persons providing relief) (4) cost of transfer from the local site, (5)miscellaneous expenses (up to a total of ¥200,000, including the cost of travel procedures for the person(s) providing relief, local transport expenses, communications expenses including international call charges, cost of disposing of the remains of the deceased). However, with regard to (4) and (5), if a claim is payable for treatment expenses for injury or treatment expenses for illness, that amount shall be deducted. "Local site" means the location of accident occurrence or the place of recovery, either in or outside Japan. |

|

Primary cases in which claims are not paid are as follows;

◇Accident and illness in the course of work or commuting(However, payment of emergency reunion expenses are provided eligible for payment in the event of death or critical illness.)

◇Pregnancy, childbirth, miscarriage and illness caused by these

◇Dental disease (However, payment is provided for dental treatment resulting from an injury)

◇An injury and illness resulting from the willful intent or gross negligence of the policyholder, insured person or insurance beneficiary.

◇An injury and illness resulting from suicidal act.(However, payment of emergency reunion expenses are provided eligible for payment in the event of death or critical illness.)

◇An injury and illness resulting from a fight or criminal act.

◇An injury and illness resulting from war, exercise of force by a foreign country or other disturbance, etc.(However, injuries and illness resulting from terrorist acts may be covered).

◇An injury resulting from an accident that occurred while driving without qualifications, when under the influence of alcohol, or in a state under which normal driving may no longer be possible, due to marijuana, opium, etc.

◇An injury and illness resulting from radioactive exposure or radioactive contamination.

◇An injury resulting from a brain disease, insanity.

◇An injury that occurred before the start or after the end of the end of the period of liability.

◇An illness that presented itself before the start of the period of liability.

◇Whiplash or lumbago, etc. with no medically objective findings

◇Vaccination fees

◇Health examination fees

◇Cosmetic surgery cost

Personal Liability

◇Compensation liability resulting from the willful intent of the policy holder or the insured person.

◇Compensation liability toward relatives cohabiting with the insured person.

◇Compensation liability caused directly by the insured person’s performance of their duties.

◇Compensation liability caused by the ownership, use or management of movable property provided exclusively for the business use of the insured person.

◇Compensation liability caused by the insanity of the insured person.

◇Compensation liability caused by the ownership, use or management of aircraft, shipping vessels, motor vehicles, and firearms.

◇Compensation liability in relation to goods on consignment (excluding guest rooms in accommodation facilities and movable property, etc. therein).

◇Compensation liability caused by violence or beating by the insured person or at the instruction of the insured person.

Contract Type・Period of Insurance・Premiums

The following table shows the insured sums and premiums of standard type contracts. For other contract types, please contact Central Insurance, Ltd.

T

y

p

e Sum Insured(Policy Amount)

Total Premiums

Accident

Illness

Personal

Liability Emergency Reunion Expenses,

etc.Period of insurance(Term of insurance policy)

Death/ Permanent Disability

Medical Treatment Expenses

Death

Medical Treatment Expenses

1

Year2

Year3

Year4

Year5

Year

1

¥7mln

¥100mln

¥7mln

¥100mln

¥100mln

¥3mln

¥8,350

¥14,620

¥20,890

¥27,150

¥33,400

2

¥10mln

¥100mln

¥10mln

¥100mln

¥10,050

¥17,580

¥25,130

¥32,670

¥40,200

3

¥15mln

¥100mln

¥15mln

¥100mln

¥12,890

¥22,540

¥32,210

¥41,870

¥51,520

4

¥7mln

¥300mln

¥7mln

¥300mln

¥8,350

¥15,150

¥21,640

¥28,120

¥34,600

5

¥10mln

¥300mln

¥10mln

¥300mln

¥10,050

¥18,110

¥25,880

¥33,640

¥41,400

6

¥15mln

¥300mln

¥15mln

¥300mln

¥13,190

¥23,070

¥32,960

¥42,840

¥52,720

※The self-contribution for personal liability is ¥0.

Various Procedures

Please contact Central Insurance, Ltd. for inquiries about procedures.

Contract information:

Central Insurance, Ltd.

Marunouchi Building 11F, 2-4-1 Marunouchi, Chiyoda-ku, Tokyo 100-6311

TEL. 03-6259-1730 FAX. 03-6259-1731

Inquiry by e-mail

Underwriting Insurers

JI Accident & Fire Insurance Co., Ltd.

For further information about this product, refer to the pamphlet.

Comprehensive Insurance for Foreign Specified Skilled Workers(Pamphlet) [PDF]

※The following language versions available.( English, Vietnamese, Indonesian)

Comprehensive Insurance for Foreign Specified Skilled Workers(Claim Form) [PDF]

※EXCEL version also available.

■When making an application

①This insurance is specifically designed for Foreign Specified Skilled Workers(i).Parties other than Foreign Specified Skilled Workers(i)(including Designated Activities (work permitted)) are not eligible for coverage.

② Central Insurance, Ltd. Is vested with rights of agency for conclusion of insurance contracts, and concludes insurance contracts, collects insurance premiums, issues receipts for insurance premiums, manages policies and performs other agency services based on an outsourcing agreement with the underwriting insurer. Therefore, a contract that has been concluded with Central Insurance, Ltd. And effectively established is deemed to be made directly with JI Accident & Fire Insurance Co., Ltd.